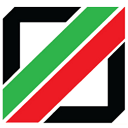

The Real Shifts in Global Logistics in 2025

Fragmentation of Global Supply Chains

By the end of 2025, fragmentation has transitioned from a reactive measure to a deliberate structural strategy. The year demonstrated that globally optimized, "just-in-time" networks have been largely superseded by semi-independent, localized supply chains. This shift was not merely about avoiding shocks; it was about building redundancy. While this increased operational complexity and overhead, the trade-off was a significant reduction in cross-regional contagion of delays.

Regionalization as an Operational Reality

Throughout 2025, the "global" in logistics became increasingly synonymous with "inter-regional." Trade flows have solidified around regional hubs—particularly in the Asia-GCC-Europe triangle. This did not signal the end of long-haul shipping, but rather a change in its function: global routes now serve as high-volume connectors between resilient regional networks. Success in 2025 was defined by a company’s ability to navigate cross-border regulatory nuances within these regional corridors.

Route Risk as a Core Planning Variable

The most decisive shift this year was the formal integration of route risk into core planning. Route selection is no longer a procurement exercise based on the lowest freight rate; it is a risk-management decision. Factors such as corridor stability, insurance premiums in volatile zones, and "route optionality" became as important as transit time. In 2025, the most competitive firms were those that maintained "warm" alternative routes, even at a slight price premium, to ensure continuity.

Asia-Centered Trade and Growing Pressure on Logistics Routes

China’s Trade Gravity

China’s Trade Gravity By the end of 2025, China’s role in global trade is best described as a persistent gravitational pull rather than mere expansion. Even as global firms pursued "China Plus One" strategies, the reliance on Chinese manufacturing networks for intermediate goods flows remained high. This gravity effect placed sustained pressure on Asia–Europe and Asia–Middle East corridors. In practice, 2025 showed that logistics networks did not decouple from China; instead, they reconfigured to manage the risks of this dependency, prioritizing route reliability and capacity over simple distance-cost metrics.

India’s Expanding Role

India’s Expanding Role India’s trade footprint in 2025 was characterized by the diversification of logistics pathways rather than the creation of a single dominant axis. As India’s export volumes surged, logistics planning had to adapt to a fragmented landscape of maritime and land-based options connecting the subcontinent to the Middle East and Europe. Unlike China’s centralized model, India’s rise introduced a layer of "strategic variability." For logistics operators, this meant that success depended on navigating a patchwork of regional ports and regulatory environments, making flexibility a more valuable asset than sheer scale.

Central Asia as a Transit Zone, Not a Destination

Central Asia as a Transit Zone, Not a Destination The year 2025 marked the functional redefinition of Central Asia within the global supply chain. The region solidified its position as a critical transit zone—a bridge linking East Asia, the Middle East, and Europe—rather than a final consumption market. Rail and road corridors across the region gained strategic weight, driven by the urgent need to shorten transit times and avoid traditional maritime bottlenecks. This shift elevated the importance of multimodal connectivity and placed a premium on transit efficiency and border-crossing speed, making the region a focal point for infrastructure investment.

|

Key Factor |

Traditional Logistics (Pre-2025) |

New Reality (2025 Trends) |

|

Primary Goal |

Cost Minimization |

Operational Resilience |

|

Supply Chain Model |

Global JIT Dominance |

Hybrid JIT with Regional Buffers |

|

Route Selection |

Lowest Freight Rate |

Risk-Adjusted Total Cost |

|

Main Corridor Type |

Maritime Default |

Multimodal & Hybrid (Land–Sea) |

|

Lead-Time Focus |

Speed & Efficiency |

Schedule Predictability & Reliability |

Why Traditional Routes Are No Longer the "Default" in Global Logistics Trends 2025

Capacity Constraints and the Shift in Maritime Strategy

One of the most visible global logistics trends 2025 has been the normalization of capacity constraints. Congestion at major ports and periodic bottlenecks in strategic waterways are no longer viewed as anomalies but as recurring operational conditions. While maritime transport remains essential, its role as the unquestioned "default" has weakened. Logistics planners have adapted to this trend by treating sea routes as part of a diversified portfolio, integrating alternative corridors to bypass the unreliability of traditional shipping schedules.

The Impact of Rising Insurance and Compliance Costs

A critical driver within the global logistics trends 2025 is the surge in risk-related overheads. Throughout the year, insurance premiums and compliance expenses have exerted a measurable influence on route selection. Coverage costs now fluctuate sharply based on the risk profile of specific corridors, creating a significant gap between nominal freight rates and the actual cost of transit. For many firms, the most economical route on paper in 2025 is often the one that minimizes insurance exposure rather than just distance.

Predictability Over Speed: Rethinking Schedule Reliability

Perhaps the most defining shift in global logistics trends 2025 is the elevation of predictability over nominal transit speed. Time uncertainty—driven by inspections, administrative friction, and rerouting—has eroded confidence in traditional delivery windows. In response, industry leaders are increasingly favoring routes that offer "operational transparency." Even when these alternatives involve higher direct costs, they provide the schedule reliability that modern, lead-time-sensitive supply chains demand.

The Rise of Land-Based and Hybrid Logistics Corridors

One of the most concrete global logistics trends 2025 was the growing reliance on land-based and hybrid corridors as a staple of mainstream logistics planning. Rather than attempting to replace maritime transport, these corridors functioned as critical, complementary options that addressed the structural limitations of traditional routes. Throughout the year, we saw rail, road, and sea increasingly integrated into unified networks designed to balance speed, reliability, and risk exposure. What distinguished 2025 was the transition of these corridors from "alternative" solutions to normalized components of global logistics strategies.

Rail–Road–Sea Combinations: The Multimodal Shift

A defining feature of global logistics trends 2025 was the expanded use of multimodal combinations linking rail and road infrastructure directly to maritime segments. These configurations allowed operators to bypass congested ports or high-risk maritime zones by switching modes mid-transit. While hybrid corridors introduced a layer of planning complexity, they enabled unprecedented routing flexibility. This shift reflects a broader trend toward operational adaptability, where the ability to switch modes is now more valuable than optimizing for a single, dominant transport method.

Cost vs. Time Trade-Offs: Prioritizing Predictability

The increased adoption of land-based corridors in 2025 forced a recalibration of traditional cost-time equations. While hybrid routes often carried higher direct transportation costs, they offered significant advantages in transit-time stability. For many companies—especially those in high-value manufacturing—this trade-off became the new standard. This reassessment reinforced a key global logistics trend 2025: the industry’s willingness to absorb higher nominal costs in exchange for the "certainty" of delivery, moving away from the fragile cost-minimization models of the past.

Risk Diversification Through Route Optionality

The most strategic implication of these corridors in 2025 was their role in route optionality. By maintaining active presence across multiple land and sea corridors, companies successfully reduced their exposure to localized disruptions. Route optionality is no longer a contingency plan; it is a core design principle. Within the landscape of global logistics trends 2025, this shift underscores a universal recognition that true resilience is built through choice and geographic flexibility, rather than dependence on a single optimized pathway.

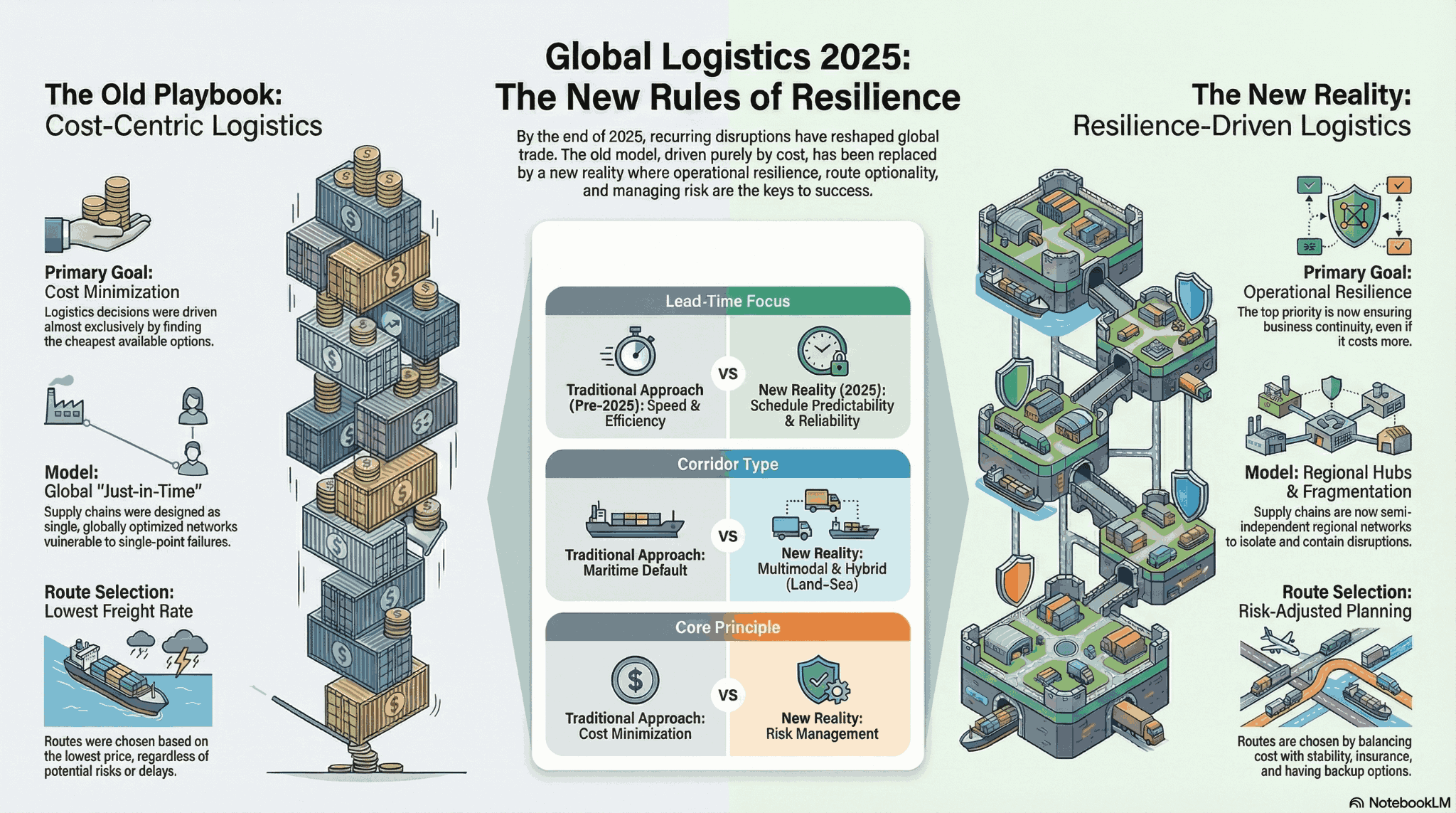

Iran’s Position as a Transit Country in 2025

Within the broader context of global logistics trends 2025, Iran’s role as a transit country is best defined by its unique geography and connectivity. Positioned at the intersection of major production and consumption hubs in Asia, Europe, and the Middle East, Iran occupies a land-based crossroads that has gained renewed strategic relevance. As companies worldwide reassessed route reliability and diversification throughout the year, Iran’s transit potential moved from theoretical discussion to operational necessity.

Geographic Logic of Iran’s Transit Hub

In 2025, the geographic logic underpinning Iran’s role became a centerpiece of regional planning. By connecting the Persian Gulf to the Caspian region and providing overland access between South Asia and Europe, Iran allows logistics networks to bypass increasingly volatile maritime chokepoints. This shift reflects a major global logistics trend 2025: the strategic move toward leveraging "bridge countries" to enhance route optionality. For global shippers, the Iranian corridor offers a shorter, land-based alternative that reduces exposure to the systemic risks of traditional maritime-only models.

North–South and East–West Connectivity: A Unified Framework

Iran’s relevance in 2025 is reinforced by its dual role in north–south and east–west connectivity.

- The International North-South Transport Corridor (INSTC): In 2025, the INSTC saw record growth, particularly along its eastern branch through Kazakhstan and Turkmenistan, linking the Indian Ocean to Northern Europe.

- East–West Silk Road Routes: Similarly, Iran’s rail and road networks facilitated overland movement between China, Central Asia, and the Middle East. The defining global logistics trend 2025 here was the integration of these corridors. They are no longer viewed as standalone projects but as flexible components of hybrid logistics networks, offering high-value transit options for goods requiring predictability over sheer volume.

Operational Realities and Local Expertise

Despite its geographic advantages, Iran’s transit role in 2025 remained shaped by practical operational realities. Infrastructure capacity, digitalization of customs procedures (such as the Single-Window Transit System), and border efficiency were critical factors in corridor performance. These challenges underscored a key lesson from global logistics trends 2025: geographic opportunity is only as effective as the local operational expertise behind it. For logistics decision-makers, success in this corridor depends on partnering with experienced local operators who can navigate regulatory nuances and ensure "infrastructure continuity" across complex transit routes.

What These Changes Mean for Logistics Decision-Makers

The global logistics trends 2025 have fundamentally shifted the role of logistics from operational execution to strategic design. Choices that were once delegated to simple cost comparisons or default routing rules now require a comprehensive assessment of risk, reliability, and regional capability. For companies operating across the critical Asia-Middle East-Europe axis, logistics has become a primary determinant of business continuity rather than a background function.

Route Selection as a Strategic Board-Level Decision

One of the most significant global logistics trends 2025 is the elevation of route selection to a board-level consideration. Selecting a transit route today implies selecting a specific risk profile, a regulatory environment, and a set of operational dependencies. Traditional assumptions about corridor stability no longer hold as universal truths, making "route optionality" central to any robust planning framework. In 2025, routes are evaluated not just for their cost-efficiency, but for their structural ability to absorb disruptions without causing cascading failures across the supply chain.

Prioritizing Risk Management Over Cost Minimization

Throughout the year, a defining global logistics trend 2025 has been the subordination of cost minimization to comprehensive risk management. Recurrent delays, volatile insurance premiums, and compliance uncertainties have proven that the "cheapest" route on a spreadsheet can become the most expensive in reality when disruptions occur. Modern decision-makers now prioritize predictability and continuity over nominal freight savings. This recalibration reflects a mature understanding of performance, where success is measured by long-term resilience rather than per-shipment margins.

The Strategic Necessity of Regional Logistics Partners

As global networks became more fragmented in 2025, the value of specialized regional logistics partners reached a new peak. Navigating complex land-based and hybrid corridors—such as those crossing Central Asia and Iran—requires deep local operational knowledge, regulatory familiarity, and on-the-ground coordination that global freight forwarders often lack.

Collaborating with experienced regional operators has emerged as a practical response to the global logistics trends 2025. Such partnerships allow global firms to manage corridor-specific risks effectively and maintain seamless service continuity across transit countries. In the current landscape, these alliances are no longer just a "support" function; they are a strategic asset for any company looking to turn logistics complexity into a competitive advantage.

Frequently Asked Questions (FAQ)

What is the most significant global logistics trend in 2025?

The shift from cost-centric to risk-centric planning. Companies now prioritize "route optionality" and predictability over the lowest shipping rates due to persistent global disruptions.

How did Iran’s role in global logistics change in 2025?

Iran transitioned from a theoretical transit route to an operational necessity, providing a critical land-bridge via the INSTC and East-West corridors to bypass maritime bottlenecks.

Why is regionalization replacing globalization in supply chains?

To reduce "contagion risk." By building semi-independent regional hubs (like the Asia-GCC-Europe triangle), businesses can isolate delays and maintain continuity during global shocks.

Are land-based corridors faster than maritime routes in 2025?

Not always faster in terms of raw speed, but they often offer higher "schedule reliability" and lower insurance volatility compared to traditional maritime chokepoints.